Doing Business in the City of San Francisco: Meeting Your Regulatory Requirements

Companies doing business in San Francisco (the city) are required to register and pay an annual registration fee. The general deadline for paying license fees for the 2023-2024 period is May 31, 2023. Furthermore, general businesses may be subject to up to four city taxes: the San Francisco Gross Receipts, Homelessness Gross Receipts, Commercial Rents, and Overpaid Executive Taxes. The filing and payment deadline for these taxes for 2022 is February 28, 2023.

San Francisco’s doing business (nexus) standards include maintaining a fixed place of business within the city; performing any work, including solicitation, within the city for all or part of any seven days during the calendar year; or generating more than $2,090,000 in San Francisco-sourced gross receipts during the calendar year. Tax filings must be made online, through the city’s website, except in certain limited circumstances. Penalties and interest will be assessed for late payments and late filings, and taxpayers should be aware that a missed or late filing may result in a higher bill.

San Francisco Annual Business Registration Fee

Every business operating in San Francisco must apply for a registration certificate and pay the registration fee along with the application. A company has 15 days after starting operations in the city to apply for the certificate.

The annual business registration fee is based on gross receipts in San Francisco for the previous tax year. Registration fees range from $54 to $41,951, or $44 to $35,955 for retailers, wholesalers, and certain services. The registration fee is due by May 31, 2023. Businesses subject to the Administrative Office Tax are subject to a different fee, as discussed below.

For qualifying businesses, San Francisco has passed the First Year Free program, which waives initial registration fees, initial license fees, first-year permit fees, and other applicable fees. If all of the applicable criteria are met, enrollment is automatic when registering as a new business or new location with the City. The Board of Supervisors extended the program until June 30, 2023 in November 2022, increased the gross receipts threshold to qualify, and expanded the types of businesses that qualify. Businesses are eligible for the tax and fee exemption if their San Francisco-sourced receipts are less than $5 million.

San Francisco Gross Receipts Tax

The gross receipts tax is imposed on every entity doing business in San Francisco and is calculated based on the entity’s gross receipts attributable to the city. Depending on the nature of a taxpayer’s business, gross receipts are attributed to San Francisco based on gross receipts attributable to San Francisco customers, employee payroll incurred in San Francisco, or some combination of the two. The term “gross receipts” is broadly defined as “the total amounts received or accrued by a person from whatever source derived, including, but not limited to, amounts derived from sales, services, dealings in property, interest, rent, royalties, dividends, licensing fees, other fees, commissions and distributed amounts from other business entities.”

Any entity doing business in San Francisco, as well as all of the entity’s unitary affiliates included in the same California combined corporate filing group, must file the gross receipts tax on a combined basis. When a combined group includes entity types other than corporations, an additional level of analysis may be required.

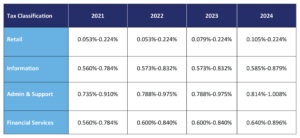

The gross receipts tax rates and apportionment methodologies are determined by a taxpayer’s business classification, which is typically determined by the entity’s NAICS code. Due to Proposition F’s passage, gross receipts tax rates have changed and will continue to increase through 2024. A simplified table documenting some of those tax changes is below:

The 2022 tax rate table will remain in effect in 2023, as the City’s 2022 tax collections fell short of the legislative goal of achieving 90% of the tax collections from the Gross receipts tax achieved in 2021. Depending on whether total gross receipts reported by taxpayers in 2023 are 95% or greater than those reported in 2019, either the 2023 tax rate table or the 2024 tax rate table above will be imposed in 2024. It is worth noting that rate changes for all tax classifications will go into effect in 2025, regardless of whether San Francisco meets its revenue collection targets.

San Francisco Administrative Office Tax

Every person conducting business in San Francisco as an administrative office is subject to a tax and a fee based on payroll expenses incurred in San Francisco. Based on payroll expenses attributable to San Francisco, the registration fee ranges from $18,288 to $42,674. For 2023, the tax rate is 1.4%.

To be considered as engaged in business within the City as an administrative office, a person must be engaged in business within the City during the tax year and over 50% of its total combined payroll expense (including related entities) within the City for the preceding tax year must have been associated with providing administrative or management services exclusively to that person or related entities. In addition, that person must have over 1,000 employees, and the total combined gross receipts of that person and its related entities reported on federal income tax returns for the preceding tax year must have exceeded $1billion.

San Francisco Homelessness Gross Receipts

Most entities with gross annual San Francisco receipts of more than $50 million are subject to the Homelessness Gross Receipts Tax. Entities that currently pay a payroll tax under the alternative to gross receipt taxes, i.e. the “administrative office” taxing regime, must also pay an additional payroll tax of 1.5%. The Homelessness Gross Receipts Tax imposes an additional rate ranging from 0.175% to 0.690% on entities and combined groups with San Francisco-sourced gross annual receipts of more than $50 million.

San Francisco Commercial Rents Tax

The Commercial Rents Tax (also known as the Early Care and Education Commercial Rents Tax) applies to businesses leasing commercial space in the City and does not apply to businesses that are exempt from the Gross Receipts and Payroll Expense Taxes. This measure, in addition to the existing Gross Receipts and Payroll Expense Taxes, imposes a new gross receipts tax of:

- 1% on amounts received by a business from the lease or sublease of warehouse space in the City;

- 5% on amounts received by a company from the lease or sublease of other commercial spaces in the city.

This tax is filed as part of the annual business tax return. To learn more, click here.

San Francisco Overpaid Executive Gross Receipts Tax

Beginning with the 2022 tax year, San Francisco imposes an additional tax on businesses with high executive pay, known as the “Overpaid Executive Gross Receipts Tax”. The tax is triggered based on a taxpayer’s or combined group’s executive pay ratio. The ratio compares the annual compensation of the company’s highest-paid managerial employee, regardless of location, to the annualized median compensation paid to full-time and part-time employees based in San Francisco for the tax year.

Compensation is defined to include “wages, salaries, commissions, bonuses, property issued or transferred in exchange for the performance of services (including but not limited to stock options), compensation for services to owners of pass-through entities, and any other form of remuneration paid to employees for services.”

If the executive pay ratio exceeds 100:1, then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 0.1% to 0.6%, depending on the computed executive pay ratio. For example, an entity with an executive pay ratio of greater than 200:1 would pay a 0.2% overpaid executive tax rate; greater than 300:1, a 0.3% overpaid executive tax rate; and so forth up to a maximum of 0.6%. Entities currently paying a payroll tax under the alternative “administrative office” taxing regime also will be subject to an additional payroll tax of between 0.4% to 2.4%, again depending on the climbing executive pay ratio of over 100:1, 200:1, and so forth, up to a maximum additional rate of 2.4%, for executive pay ratios greater than 600:1.

If you have any questions regarding the requirements for filing, please contact us for additional information.