IRS Issues Flexible Guidance on QIP, bonus depreciation and other favorable elections under CARES Act

On April 17, 2020, the IRS released Revenue Procedure 2020-25 (the “Rev Proc”), which provides guidance to enable taxpayers to accelerate their cost recovery of qualified improvement property (QIP). This guidance comes in response to Congress’ enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which includes a technical correction to the recovery period for QIP from 39 years to 15 years. This reclassification also makes QIP eligible for bonus depreciation under the general depreciation system (GDS) which is currently 100% of the cost through 2022, ratcheted down by 20% per year through 2026. The guidance provides additional unexpected flexibility for taxpayers in exercising hindsight to optimize cash flow and liquidity under the CARES Act.

Qualified Improvement Property

QIP includes any improvement made by the taxpayer to the interior of nonresidential real property. The improvement must be placed in service after the building was first placed in service. Improvements do not qualify if they relate to the internal structural framework of the building, an elevator or escalator, or an enlargement to the building. QIP should have been granted a 15-year recovery period under GDS (or 20-year under ADS, the alternative depreciation system) and been eligible for bonus depreciation since 2017. However, a drafting error in the Tax Cuts and Jobs Act (TCJA), known as the “retail glitch,” did not include QIP in the list of 15-year property, making it ineligible for bonus depreciation. The CARES Act retroactively corrected the error allowing taxpayers to elect to treat QIP placed in service after Dec. 31, 2017 as 15-year property that is eligible for bonus depreciation. Pursuant to the Rev. Proc. a taxpayer can elect to correct its cost recovery of QIP for prior years by (1) attaching Form 3115 (Application for Change in Accounting Method) to a federal income tax return, or (2) filing an amended federal income tax return or an Administrative Adjustment Request (AAR).

Change in Accounting Method

The first option available to the taxpayer is to change its accounting method for QIP. The Rev. Proc. allows taxpayers to file Form 3115 to make an automatic change to their accounting method even if cost recovery for the QIP was only claimed once on a previous tax return (an accounting method is usually established only after two consecutive returns are filed). The Form must be timely filed with the original Federal income tax return or Form 1065 for either the taxpayer’s first or second taxable year after the taxable year in which the taxpayer placed the QIP in service, or, if later, that is timely filed between April 17, 2020, and October 15, 2021.

For example, in the case of QIP placed in service in 2018, if the 2019 tax return has not yet been filed, the correction to 100% bonus expensing could be made either on a Form 3115 filed with the 2019 return or by amending the 2018 return. If the 2019 tax return has already been filed, the 2018 benefit could be claimed on a Form 3115 filed with the 2020 tax return or by amending both the 2018 and 2019 returns.

Amended Return or Administrative Adjustment Request

The second option for taxpayers is to amend their previous returns that classified QIP as 39-year property. The Rev. Proc. specifically allows partnerships to amend their return even if it would normally be required to file an AAR pursuant to the special audit rules of the Balanced Budget Act of 2015. When amending a return or filing an AAR, the taxpayer must include the adjustment to taxable income caused by the change in QIP and any other ancillary changes to taxable income. Additionally, if any returns have already been filed for the tax years subsequent to the year that is being amended, such returns must be amended as well for any collateral adjustments. The amended return or AAR must be filed before October 15, 2021 (but not after the applicable period of limitations on assessment).

Other Elections for Bonus Depreciation and ADS

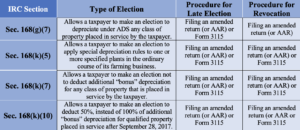

The new 15-year recovery for QIP could adversely affect some taxpayers based on individual circumstances, including interactions with the limited window for the 5-year carryback of NOLs and the increased deductibility of interest expense under Section 163(j) under the CARES Act. Anticipating such circumstances, the Rev. Proc. also provides taxpayers increased flexibility to reevaluate and make or revoke depreciation elections they made or did not make in prior years, including elections under Sec. 168(k)(5), (7), (10), and (g)(7).

Similar to the amended return requirements for the QIP election, the amended return or the AAR filed to make one of these late elections or revocations must include the adjustment to taxable income as well as any collateral adjustments to taxable income or tax liability. Also, all late elections and revocations must be made on or before October 15, 2021.

Tax Planning Implications

The flexibility offered by Rev. Proc. 2020-25 provides numerous opportunities for taxpayers. Taxpayers that have made significant QIP expenditures since 2017, and are in a taxpaying position, should take advantage of the change to immediately convert tax liabilities into cash. Specifically, C Corporations should evaluate their tax positions to see if claiming bonus depreciation on QIP could create or increase a net operating loss (NOL) in years from 2018-2020 that can now be carried back up to five years under the CARES Act to years in which the top corporate tax rate was 35%. The CARES Act also allows NOLs generated during those years to offset 100% of taxable income in that same period, potentially making this election even more favorable for C Corporations. Finally, taxpayers should reevaluate their previous depreciation elections to see if the 20/20 hindsight afforded by the Rev. Proc. provides an immediate path to more cash in the door which is what the CARES Act is all about.