Oregon taxpayers to receive record $5.6 billion kicker tax rebate

Oregon taxpayers can anticipate receiving an unprecedented kicker tax rebate of $5.6 billion, based on the near-final forecasts released on Wednesday. This rebate works out to the median taxpayer receiving approximately $980, nearly three times larger than the previous kicker.

This substantial payout underscores Oregon’s economic resilience following the pandemic, along with the underestimated strength of its economic rebound and the influence of inflation and rising wages on state revenue.

The latest forecast, issued on Wednesday, represents the final estimate before economists officially certify the kicker payout’s size in October, implying that any changes to the amount are unlikely.

Under Oregon’s distinctive kicker law, surplus revenue beyond the forecast by more than 2% is returned to taxpayers. These payouts occur at the conclusion of each two-year budget cycle, taking the form of tax credits when Oregonians file their taxes in the spring.

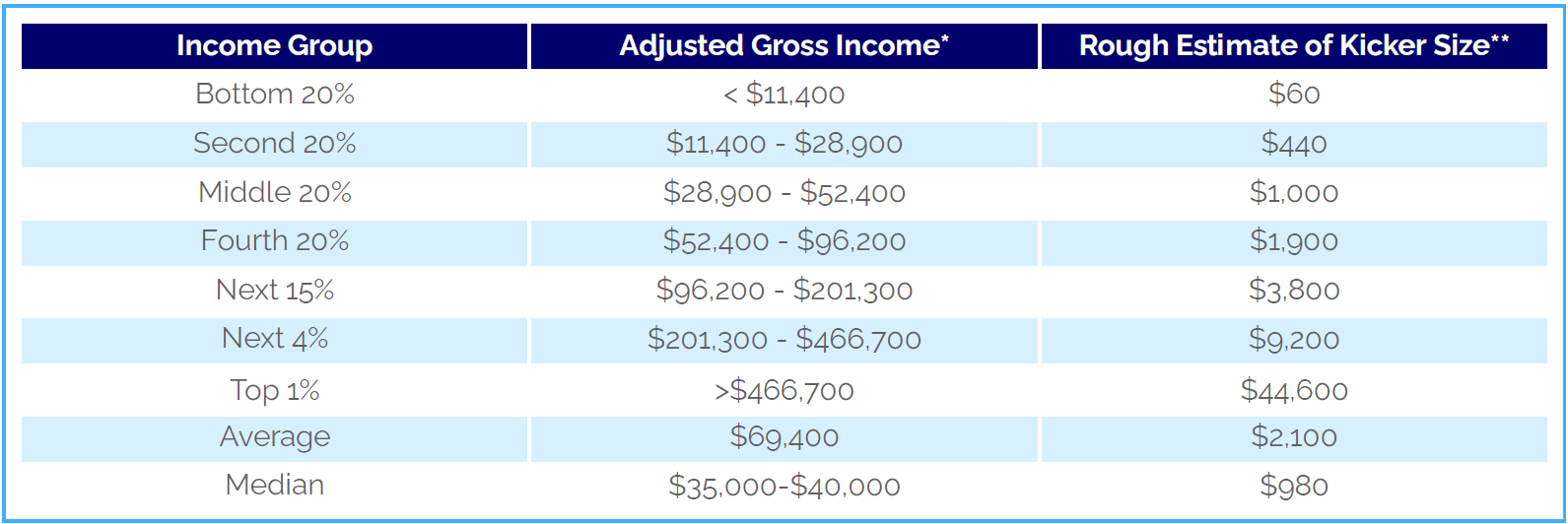

The specific amount of the kicker rebate received by each taxpayer varies based on their income level. The median rebate of $980 will be allocated to individuals in the middle tax brackets. Lower-income Oregon residents will receive less, approximately $60, while the high income earners, who contribute the most in taxes, will be entitled to tax credits exceeding $40,000.

*Based on 2020 actual tax returns

**Based on 2020 actual tax returns, PIT kicker amount ($5.6billion) and the Oregon Office of Economic Analysis’s forecast tax liability

Source: Oregon Office of Economic Analysis

The upcoming kicker payout results from robust personal income over the previous two years and the challenge faced by state economists in accurately predicting its growth rate. This challenge was partly due to an outdated economic model that did not account for inflation’s impact on state revenue.

Economists revised their models in the spring, and their predictions have since closely aligned with actual revenue performance. Mark McMullen, state economist, noted, “Recent revenues have tracked very closely to expectations.”

If you have any questions, reply to this email or contact your KBF professional.